Time Weighted Return

What is it, and how is it calculated?

Time-Weighted Return (TWR) Definition

Time-Weighted Return (TWR) is a measure of investment performance that eliminates the impact of external cash flows (deposits and withdrawals) to reflect the pure performance of an investment or portfolio over time. It is particularly useful for evaluating portfolio managers because it isolates their investment decision-making from investor-driven cash flows.

Practical Explanation

Time-weighted return shows how your investments performed on their own, without being affected by when you added or withdrew money. It removes the impact of deposits and withdrawals so you get a clear, fair picture of how well the investments themselves actually grew.

Analogy: Imagine judging a baker by tasting their cake—not by how many times someone added or removed slices. Time-weighted return focuses only on how good the cake is, not how many slices came and went.

How Deposits and Withdrawals Are Treated - Deep Dive

TWR breaks the total return period into sub-periods, each of which begins when there is a cash flow (a deposit or withdrawal). The return for each sub-period is calculated separately, and these returns are then compounded to determine the overall return. This ensures that cash flows do not distort performance.

Here’s how it works:

Divide the Time Period into Sub-Periods:

- Each sub-period runs from one cash flow event to the next.

- A new sub-period starts whenever an external cash flow (deposit or withdrawal) occurs.

Calculate the Return for Each Sub-Period:

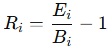

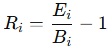

- The return for each sub-period is calculated using the formula:

- where:

- = Return for sub-period ,

- = Portfolio value at the beginning of the sub-period,

- = Portfolio value at the end of the sub-period (before any new deposits or withdrawals).

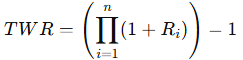

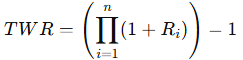

Chain-Link (Compound) the Sub-Period Returns:

- Once all sub-period returns are calculated, they are compounded together to get the overall return:

- where is the total number of sub-periods.

Why This Method?

- Neutralizes the impact of cash flows since they are not included in the return calculation.

- Accurately reflects the portfolio manager's skill, as it isolates the investment returns from investor behavior