Completing Your DocuSign Account Packet

A Step-by-Step Guide

Setting up a new investment account involves several important documents and signatures to ensure everything is compliant and aligned with your goals. In this guide, we’ll walk you through the process of completing a new Account Packet in DocuSign, including what to expect and how to navigate the forms confidently.

Watch this video to walk through the process

What’s in Your DocuSign Account Packet?

When you receive your new account packet via DocuSign, it may include several key documents:

-

Client Intake Form

-

Risk Meter and Investment Policy Statement – Signature required

-

FG Asset Management Advisory Agreement – Signature required

-

Custodian Account Opening Paperwork – Signature required

-

FG Asset Management ADV2A – For client records only; no signature required

-

FG Family Office Services ADV2A – For client records only; no signature required

-

Advisor’s ADV2B – For client records only; no signature required

Each of these serves a unique role in establishing your investment profile, custodian account setup, and compliance with fiduciary standards.

Accessing Your Packet

You’ll receive an email from Asset Support or possibly from Client Success, containing a secure link to your DocuSign documents.

Step 1: Start the Process

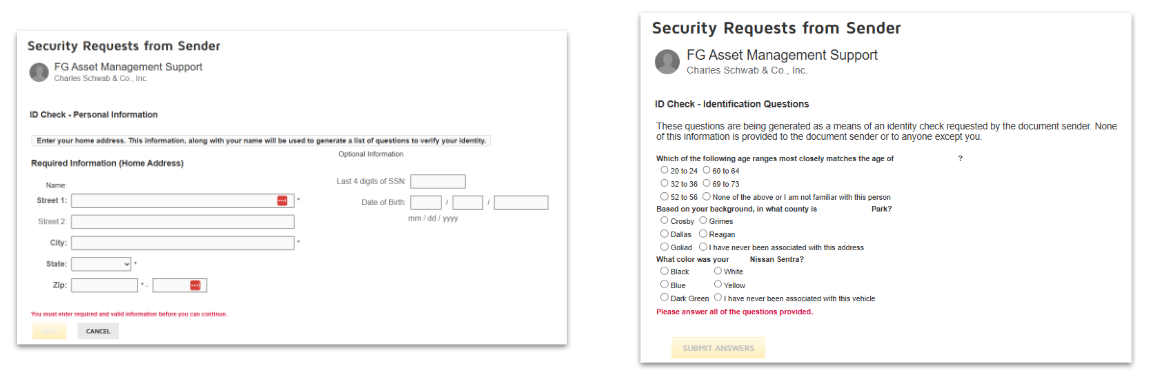

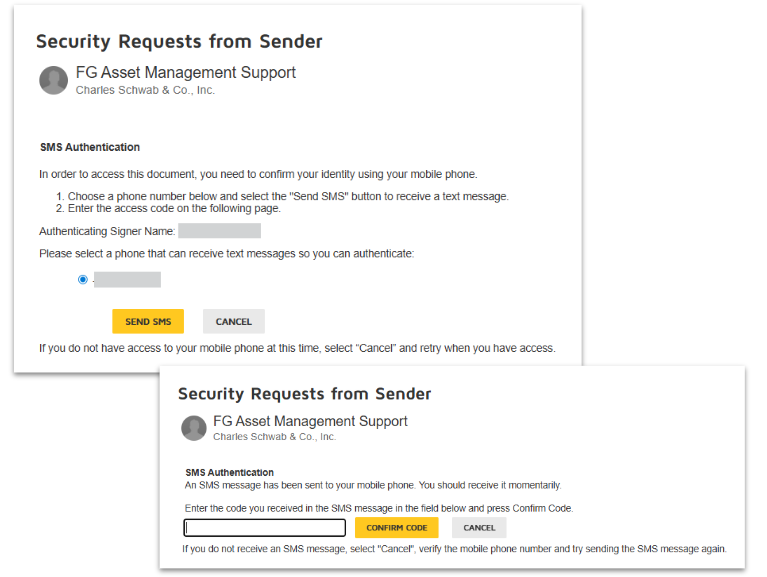

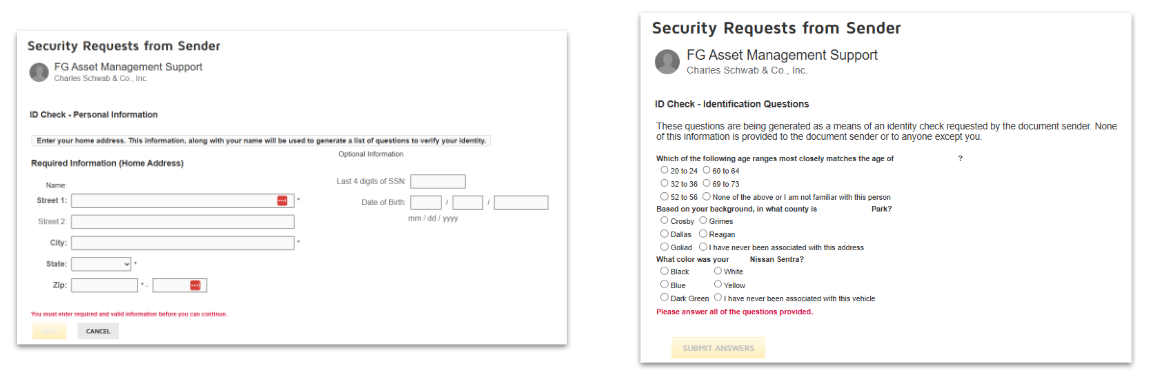

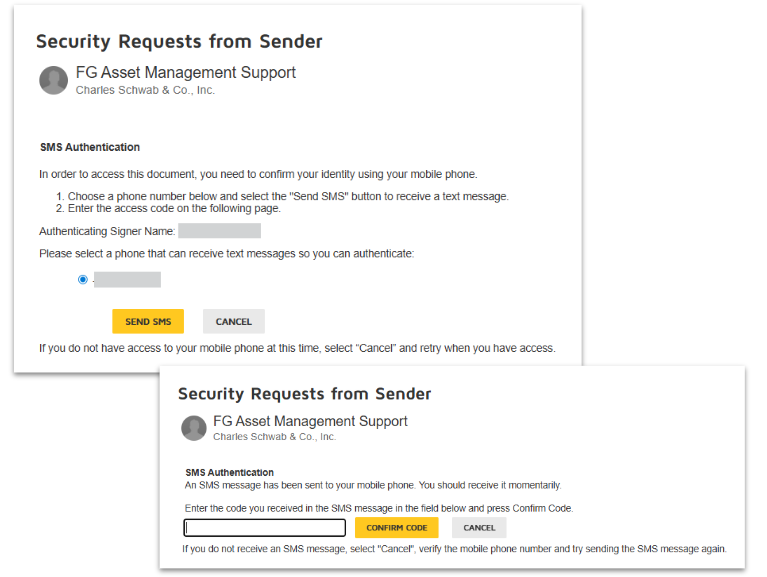

Click on the “Review Documents” button in the email to begin. DocuSign requires a two-step authentication process for your security:

- Identity Verification – You may be asked to answer personal questions (e.g., vehicles you’ve owned, prior addresses).

- Phone Verification – A code will be sent to your registered phone number. Enter and confirm the code to proceed.

Step 2: Advisor Review and Document Edits

Before the packet reaches you, your advisor will typically review and sign the necessary documents. Once it’s your turn:

-

Review the fields carefully.

-

If any details need updating, simply click into the editable fields within DocuSign to make corrections.

-

Fields highlighted in solid colors indicate required information. Be sure not to skip these, as they are essential for processing.

This section below will go over the forms you may find in the packet

Client Intake FormsThere are three different types of intake forms, but most often the Standard one will be used. Below are the sections and some imprtoant details about each section:

|

Risk Meter and Investment Policy Statement – signature requiredYour Advisor will guide you through the Risk Meter to help you identify a risk level you feel confident and comfortable with. Below is an example of what that may look like:

|

FG Asset Management Advisory Agreement – signature requiredThis agreement establishes the advisory relationship and specifies the management fees for your accounts.

|

Custodian account opening paperwork – signature requiredBased on your account types, the number of accounts, and transfer information, some custodian documents may need your review and signature. Below is an example of what they may look like:

|

FG Asset Management and FG Family Office Services ADV2A, and Advisor’s ADV2BFor client records only, no signature required What is an ADV?: ADVs are Brochure Supplements that provide detailed background information on the Individual investment adviser representatives (IARs) and the firm as a whole.

|

Step 3: DocuSign Completion

Once you’ve reviewed the document and completed all required fields, you can click 'Finish.'

- If there is a secondary account holder, they will also need to complete this process before the DocuSign is finalized.

- After all parties have signed, the document will be routed to the custodian for processing.

Need Assistance?

Completing your DocuSign Account Packet is an important first step in starting or updating your investment journey. The process is designed to be secure, thorough, and collaborative, ensuring that both you and your advisor are aligned on your investment profile.

If you have questions, you can contact the FG Client Success Team (CST) by calling (800) 588-3893, option 2, or by emailing clientsuccess@financialgravity.com. You can also use our public knowledge base to self-serve your needs by visiting: https://knowledgebase.financialgravityapps.com/home